JANUARY 2024

Celebrating 2024 & Leaning Into 2025

We’re thrilled to share highlights from last year and our early successes in this new year as we work to shape the future of healthcare IT. Keep reading for our 2024 year end recap, Ryan McLelland’s recent participation in Civitas’ FHIR webinar, driving progress with the One Utah Health Collaborative, and making a positive impact for our customers, partners, and community in 2025.![]() We joined Bluesky! Let’s connect @uhinhealth.bsky.social

We joined Bluesky! Let’s connect @uhinhealth.bsky.social

Spotlight

2024 Unwrapped: UHIN’s Year in Review

Unwrap an exciting year all in one infographic. We announced our affiliation with Comagine Health and launched the new CHIE portal. We re-invested 100% of our net income to enhance our products and services and achieved a remarkable 95% customer satisfaction rate.

Our Clearinghouse solution processed 329 million transactions, while the CHIE supported 33 of 36 short-term acute care hospitals in Utah, and delivered over 18 million ADT alerts. Click below and unwrap even more from 2024.

From the UHIN Blog

Catch Up on our 2024 Blog Posts

Did you miss any of our blog posts from last year? Head to the UHIN blog for valuable insights and perspectives on a variety of topics, like FHIR, cybersecurity, the power of resilient healthcare technology systems, Health Data Utilities, the ideal clearinghouse for providers, virtual payer panel recaps, and more!

HIT News

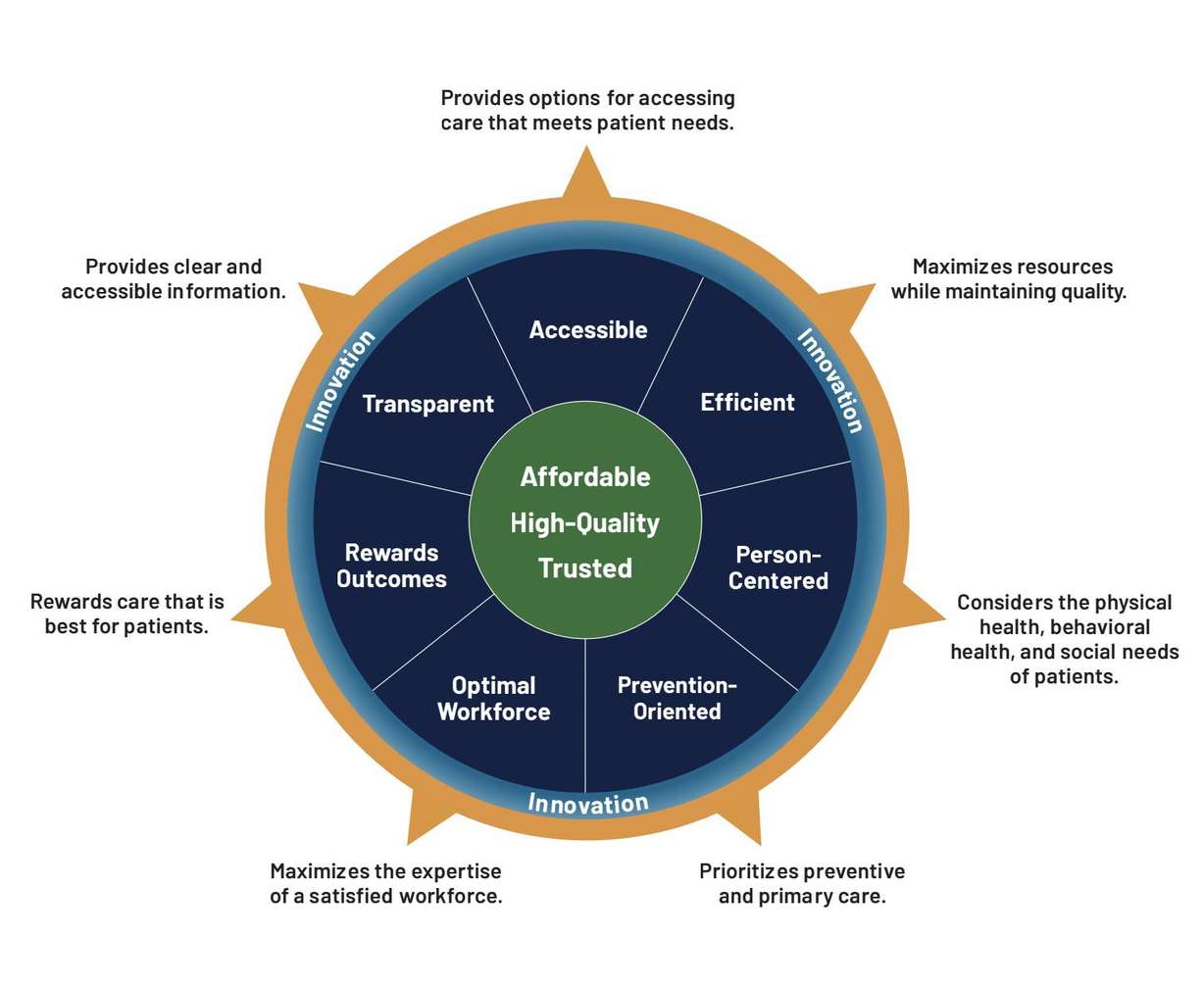

One Utah Health Collaborative in 2025

We’re proud to be a member of the One Utah Health Collaborative’s Stakeholder Community Board, which includes other notable stakeholders from across the state. Together, we’re driving alignment and progress toward advancing the Utah Model of Care and the 2025 strategic priorities to commit, plan, and act.

Events

Upcoming Conferences + President’s Day

We will attended the X12 Winter Standing Meeting in Philadelphia, PA from February 2-6.

We will sponsor the Aspen Grove Provider Fair in Orem, UT on February 7.

Our offices will be closed on February 17 for President’s Day.

Trainings and Webinars

Ryan McLelland on the FHIR Deep Dive Webinar

CIVITAS invited our CTO, Ryan McLelland, to participate in their “FHIR Deep Dive Series” earlier this month. He shared our exciting progress on a state-wide pilot program to create cohesive FHIR-based ecosystems in Utah supported by Da Vinci Trebuchet and eHealth Exchange. Click below to watch!

Wrapping Up

Comagine Health & CMS Partnership to Strengthen Healthcare for AIAN Communities

Congratulations to our affiliate partner, Comagine Health, for their continued partnership with the Centers for Medicare & Medicaid Services (CMS) in advancing the American Indian/Alaska Native (AIAN) Quality Improvement (QI) Program. The newly awarded contract builds upon previous CMS-funded work with Indian Health Service (IHS) hospitals and providers in 261 facilities within IHS, tribally managed health care facilities, Urban Indian Organizations (UIOs) and CMS-designated nursing homes across the nation.